Why Your Bank Insists on 1600 Numbers (And Why It Actually Matters)

Here’s a scenario you’ve probably lived through: Your collections team starts making calls using regular mobile numbers. First day goes well. By day three, half your numbers are marked as spam. By week two, you’re looking at a 15% pickup rate and your telecom provider is sending you warnings.

Sound familiar?

This isn’t just bad luck. It’s the new reality of outbound calling in India, and it’s exactly why TRAI just made 1600 numbers mandatory for every bank, NBFC, and insurance company in the country.

The Regulatory Push That Changed Everything

In December 2025, TRAI issued a directive requiring all IRDAI-regulated insurance entities to transition to 1600 series numbers by February 15, 2026. This followed similar mandates issued in November for banks and financial institutions, with deadlines already hitting in January 2026.

This isn’t a suggestion. It’s law. And the penalties for non-compliance? Any entity continuing to use non-1600 numbers after their deadline will be treated like an unregistered telemarketer, facing suspension or disconnection of communication resources.

Why the sudden urgency? Because the problem got out of hand.

What Went Wrong with Regular Numbers

Over the past few years, India’s telecom ecosystem became hyper-aggressive about spam prevention. That’s great when you’re on the receiving end of a “Congratulations! You’ve won a lottery” call. But it’s brutal when you’re a legitimate financial institution trying to reach your own customers.

Here’s what happens when you use regular GSM numbers for BFSI calling:

Network-level throttling kicks in after burst patterns. Your perfectly legitimate reminder calls start getting blocked because they look like spam campaigns to the carrier’s AI.

Handset-level spam tagging means even if the call goes through, the customer sees “Suspected Spam” flash on their screen. Most people won’t answer. Would you?

Low answer rates become the norm. We’re talking 20-30% pickup rates instead of the 60-70% you’d get from a trusted number. Your entire economics break down.

Frequent blocking after just a few hundred calls. You think you’re scaling up. The network thinks you’re a spammer.

For collections, loan reminders, KYC verification, or fraud alerts the backbone of BFSI operations this is a death sentence. You can’t run a compliant operation when your calls don’t even ring.

Why 1600 Numbers Are Different

The 1600 numbering series has been assigned by the Department of Telecommunications exclusively for BFSI sector entities and Government organizations to clearly distinguish their service and transactional calls from other commercial communications.

Think of it as a verified badge for voice calls.

When a customer sees a 1600 number calling them, they know three things immediately:

- This is a regulated financial institution

- This is a service or transactional call, not a sales pitch

- This number has been verified and approved by the telecom regulator

The network knows it too. 1600 numbers are designed for high-volume outbound calling from verified organizations, which means they don’t get randomly throttled or blocked like regular numbers do.

From a pure delivery standpoint, 1600 numbers behave predictably. They maintain consistent pickup rates. They don’t get flagged after reaching certain volume thresholds. They signal legitimacy at both the network level and the customer level.

The Compliance Angle Nobody Talks About

When your bank’s risk team approves a voice automation vendor, they’re not just approving technology. They’re approving operational risk, regulatory risk, and reputational risk.

Here’s what keeps compliance teams up at night:

DLT alignment — Every outbound call needs to be traceable to a registered entity and template. 1600 numbers make this audit trail clean and verifiable.

Customer complaint risk — When customers file complaints about spam calls, someone has to answer for it. 1600 numbers reduce customer complaints and spam flags because they’re easily identifiable.

Regulatory scrutiny — TRAI has regularly engaged with telecom operators and BFSI sector regulators to promote adoption. They’re watching who complies and who doesn’t.

Audit readiness — Can you prove every call you made was compliant? With 1600 numbers tied to DLT-registered templates, yes. With rotating mobile numbers? Good luck.

This is why serious banks won’t even look at a voice platform unless it supports 1600 calling properly. It’s not conservatism. It’s survival.

Where Most Voice AI Platforms Fail

Look, we’ve all seen the demos. The AI sounds great. The conversation flows naturally. The automation promise is real.

Then deployment happens, and reality hits.

Many voice platforms focus entirely on the AI conversation layer and treat telecom as an afterthought. The common mistakes we see:

Using rotating mobile number pools to scale beyond what one number can handle. This works for two weeks until the entire pool gets blacklisted.

Bypassing DLT logic to “improve delivery rates” in the short term. Sure, your calls go through today. But when the audit happens, or when customers start complaining, you’re done.

Treating compliance as the client’s problem. “Just get us the numbers, we’ll handle the calling.” Except when those numbers get blocked, suddenly everyone’s looking for answers.

The brutal truth is that most voice AI platforms were built for markets where telecom is simpler. When they try to operate in India’s BFSI environment, they hit a wall.

Numbers get blocked. Campaigns stop. Vendors scramble to find new numbers. Pickup rates collapse. And eventually, the bank’s compliance team steps in and shuts the whole thing down.

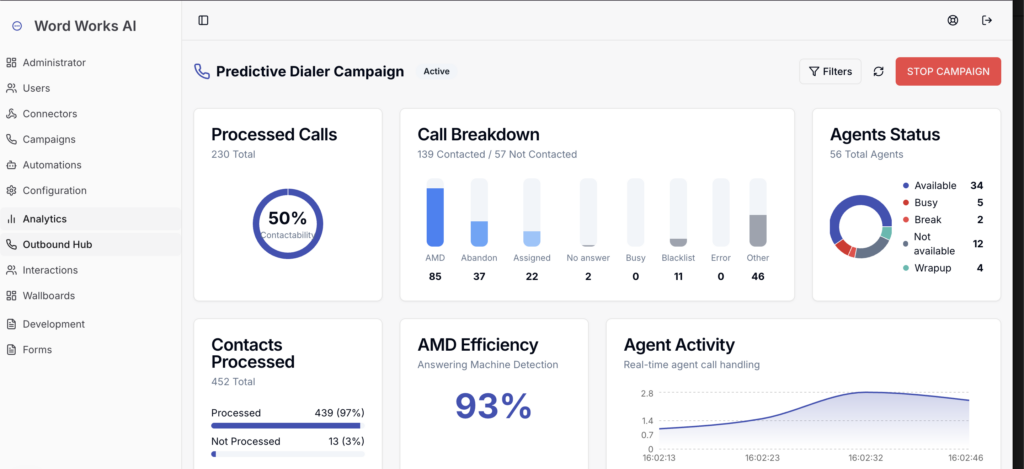

How We Think About 1600 at WordWorks AI

We designed WordWorks AI to work within India’s BFSI telecom stack from day one, not as a workaround to it.

We don’t issue numbers. We don’t try to bypass the system. We integrate cleanly into how enterprise telecom is supposed to work.

Here’s what that means practically:

Client-owned 1600 ranges — The numbers belong to the bank, not to us. We dial through their approved telecom infrastructure, maintaining full visibility and control.

DLT enforcement baked in — Every call is mapped to a DLT-registered entity and template before it goes out. This isn’t optional configuration. It’s hardcoded into how the platform works.

Service vs. transactional classification — The platform understands the difference and routes accordingly. Collections calls go out differently than fraud alerts, both technically and in terms of timing.

Calling windows and retry logic — TRAI has clear rules about when you can call and how often. Our platform enforces these rules automatically, so your team doesn’t have to manually track exceptions.

Full audit trails — Every call, every attempt, every outcome is logged with timestamps and compliance markers. When the audit happens (and it will happen), you’re ready.

This is why our deployments survive bank risk reviews instead of dying in them. The compliance team looks at the architecture, sees that it’s built correctly, and gives the green light.

The Real Reason This Matters

Voice automation in BFSI isn’t just about AI quality. It’s about trust at every layer of the stack.

You need trust from:

- The telecom network (so your calls actually go through)

- The regulator (so you don’t get shut down)

- The compliance team (so you get approved in the first place)

- The end customer (so they actually answer)

1600 numbers are one of the strongest trust signals available in India’s telecom ecosystem today. About 570 entities have already adopted 1600 series numbers, subscribing to over 3,000 numbers, and that number is growing rapidly as deadlines hit.

If your voice platform doesn’t support 1600 properly not as a feature, but as a foundation then it doesn’t matter how good the AI sounds. You won’t make it past the first compliance review, and even if you do, your campaigns won’t survive production scale.

What This Means for Your Operations

If you’re running outbound calling operations for a bank or NBFC right now, here’s what you need to know:

Your deadlines are real and they’re close. Commercial banks had to migrate by January 1, 2026. Large NBFCs by February 1. Insurance companies by February 15. If you’re still using regular numbers, you’re out of time.

Migration isn’t just about getting new numbers. You need to integrate those numbers into your existing telecom infrastructure, set up DLT mappings, configure calling windows, implement retry logic, and establish audit trails. This takes planning.

Your voice automation vendor needs to support this properly. Not as a workaround, not as a “we’ll figure it out later” promise, but as proven, production-ready functionality.

The good news? The 1600 series framework will enable citizens to reliably identify legitimate calls originating from regulated financial institutions. Once this ecosystem stabilizes, your legitimate calls will get through more reliably than they do today.

But you need to be compliant first.

Final Thought

Banks didn’t ask for 1600 numbers because they’re being difficult. They asked for them because they learned the hard way that shortcuts don’t work in regulated environments.

Any voice automation platform serious about BFSI must treat 1600 compatibility as table stakes, not a feature.

That’s the difference between a demo that impresses stakeholders and a system that survives production.

Want to see how WordWorks AI handles 1600 enterprise calling for regulated BFSI workflows? We’re happy to walk through our telecom architecture and compliance approach. Get in touch.