Agentic AI in Fintech: How WordWorksAI is Powering Autonomous Financial Innovation

Discover how WordWorksAI is transforming the fintech industry with Agentic AI menabling autonomous wealth management, AI-driven underwriting, fraud detection, and more.

Introduction: Fintech Meets Agentic Intelligence

The fintech industry is undergoing a paradigm shift powered by Agentic AI an emerging form of artificial intelligence capable of acting autonomously, making decisions, and learning from experience. Unlike rule-based automation or narrow AI, agentic systems can perceive environments, reason about situations, act independently, and adapt over time without direct human control.

In the high-speed world of financial technology, where precision, personalization, and predictive insights drive growth, WordWorksAI is at the forefront of this revolution. Through its robust Agentic AI solutions, WordWorksAI is redefining how fintech companies engage customers, manage risk, enhance compliance, and automate complex processes.

This comprehensive article explores how Agentic AI delivered through WordWorksAI’s platform is transforming the fintech landscape and setting a new standard for intelligent financial operations.

What is Agentic AI?

Agentic AI refers to autonomous systems with the capability to:

- Perceive data and environments through real-time inputs+

- Reason using contextual and historical data to form judgments

- Act independently to achieve defined goals

- Learn from feedback and adapt over time

Unlike traditional AI that requires explicit programming for each scenario, Agentic AI behaves like a cognitive assistant—constantly evolving its behavior based on changing variables. In fintech, this means faster decision-making, lower operational friction, and more intelligent customer interactions.

WordWorksAI: The Agentic AI Powerhouse for Fintech

WordWorksAI is a leading AI technology company specializing in building agentic AI platforms for enterprise applications. For the fintech sector, it offers a suite of intelligent agents tailored to improve everything from customer acquisition to regulatory compliance.

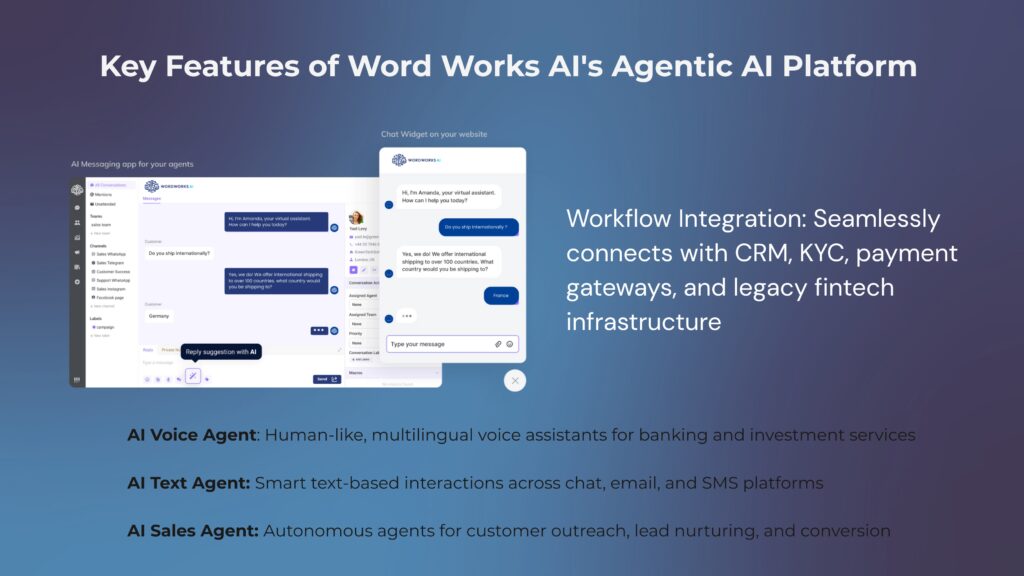

Key Features of Word WorksAI’s Agentic AI Platform

With these solutions, WordWorksAI helps fintechs automate complex processes, reduce operational costs, and provide hyper-personalized services at scale.

Top Use Cases of Agentic AI in Fintech

1. Autonomous Wealth Management

The future of wealth management is powered by intelligent robo-advisors that go beyond static questionnaires. WordWorksAI enables the creation of autonomous financial advisors that:

- Understand user goals and risk profiles

- Monitor markets in real time

- Adjust portfolios dynamically

- Communicate personalized insights through voice or text

With Agentic AI, fintech startups and banks can offer high-touch advisory services to retail customers without needing human advisors at every step.

2. AI-Driven Credit Underwriting

Traditional credit scoring models often miss out on millions of underbanked individuals. WordWorksAI’s agentic scoring systems leverage alternative data transaction histories, behavioral signals, and even social graphs to create dynamic, fairer credit models.

These agents:

- Evaluate borrowers in real time

- Adjust underwriting decisions as new data emerges

- Help lenders reduce default risks while expanding access to credit

3. Real-Time Fraud Detection and Prevention

Financial fraud is constantly evolving. Agentic AI agents from WordWorksAI are built to autonomously detect anomalies by continuously scanning transaction data, user behaviors, and device patterns.

They can:

- Flag suspicious activity in milliseconds

- Automatically trigger alerts, freeze accounts, or request additional verification

- Learn and adapt to new fraud tactics using reinforcement learning

This offers a proactive fraud prevention model that evolves with the threat landscape.

4. Hyper-Personalized Customer Service

Customers demand fast, intuitive, and 24/7 support. WordWorksAI’s AI Voice and Text Agents handle millions of customer queries simultaneously with emotional intelligence and contextual awareness.

Capabilities include:

- Cross-channel support (app, WhatsApp, email, voice)

- Dynamic personalization using CRM and transaction data

- Upselling and cross-selling financial products

By automating 90%+ of queries, financial institutions reduce overhead while enhancing satisfaction.

5. Regulatory Compliance and KYC Automation

Agentic AI is a game changer for compliance. WordWorksAI agents can autonomously monitor new regulatory changes, flag non-compliant behaviors, and generate audit-ready reports.

They also assist with:

- Automating Know Your Customer (KYC) checks

- Performing risk scoring on customers and transactions

- Ensuring real-time alignment with AML, GDPR, and PSD2

The Strategic Value of Word Works AI in Fintech

Efficiency at Scale

By deploying WordWorksAI’s Agentic AI agents, fintech companies can scale operations without proportional headcount growth. Whether it’s handling 10,000 loan applications or serving 1M+ users via support channels, AI agents deliver unmatched efficiency.

Cost Reduction

Automation reduces reliance on human labor for repetitive or analytical tasks. In fact, WordWorksAI clients report:

- Up to 60% reduction in operational costs

- 90% decrease in customer query resolution time

- 50% lower cost per lead in sales cycles

Real-Time Adaptability

Agentic AI isn’t just reactive it’s adaptive. WordWorksAI agents adjust responses, strategies, and workflows based on live data feeds, customer sentiment, or financial market conditions.

This means fintech companies remain agile and competitive in volatile environments.

Enhanced Customer Experience

Personalized interactions drive retention. With agents that understand user behavior, language preference, and historical transactions, WordWorksAI enables empathetic, human-like digital experiences.

Why Fintechs Choose WordWorksAI for Agentic Intelligence

1. Enterprise-Grade Security

Security is paramount in finance. WordWorksAI follows bank-grade encryption, ISO 27001 compliance, and offers on-premise deployment options for regulated environments.

2. Seamless API Integration

WordWorksAI’s agents integrate easily with:

- Core banking platforms

- CRMs (Salesforce, HubSpot)

- Payment gateways (Stripe, PayPal)

- Messaging apps (Slack, WhatsApp)

This means no disruption to your existing stack.

3. Customization and Control

Whether you’re a neobank or a crypto exchange, WordWorksAI offers:

- Custom workflows

- Domain-specific tuning

- Fine-grained control over decision-making logic

This ensures each deployment aligns with your brand, regulations, and user needs.

Industry Case Study: Neobank Deployment with WordWorksAI

A leading European digital bank partnered with WordWorksAI to automate their onboarding, loan underwriting, and support functions.

Results After 6 Months:

- 75% of loan applications fully processed by AI agents

- 3X improvement in customer onboarding time

- 40% boost in customer satisfaction (CSAT)

- 100% regulatory compliance via automated checks

The bank is now expanding agentic automation to wealth management and fraud monitoring, showcasing the scalability and flexibility of WordWorksAI’s solutions.

Looking Ahead: The Future of Fintech with Agentic AI

As financial services evolve, Agentic AI will become a core capability not just a differentiator. In the next 3–5 years, expect to see:

- Autonomous financial planning apps managing users’ entire budgets

- Self-learning investment bots operating at retail scale

- Decentralized agentic ecosystems in blockchain and Web3 fintech platforms

WordWorksAI is positioned to lead this shift, offering not only cutting-edge tools but also strategic partnerships, compliance support, and domain expertise for fintechs aiming to future-proof their operations